Table of Contents

Withdrawal at Kotak Mahindra Bank ATMs

1. It gives you 5 Free transactions per month.

2. Also, Rs.8.50 + GST charged per non-financial transaction after the first 5 free ones.

3. The bank will be charged you Rs.20 + GST per financial transactions after the first 5 free ones.

Debit card charges are subjected to salary credit in Kotak Mahindra Bank. When the salary is not credited for the three consecutive months, then the accounts that usually have more than five free transactions at self and other bank ATMs are stripped off the extra perks and will permit to only 5 free transactions atself ATMs, disregarding of any corporate offering.

Withdrawal at Other Bank ATMs

1. After the first five free transactions, a total of 3 more transactions is allowed.

2. It will give you 5 Free transactions per month

3. The Kotak Bank will charge Rs.20 + GST per financial transactions after the first 5 free ones.

4. Also, Rs.8.50 + GST charged per non-financial transaction after the first 5 free ones.

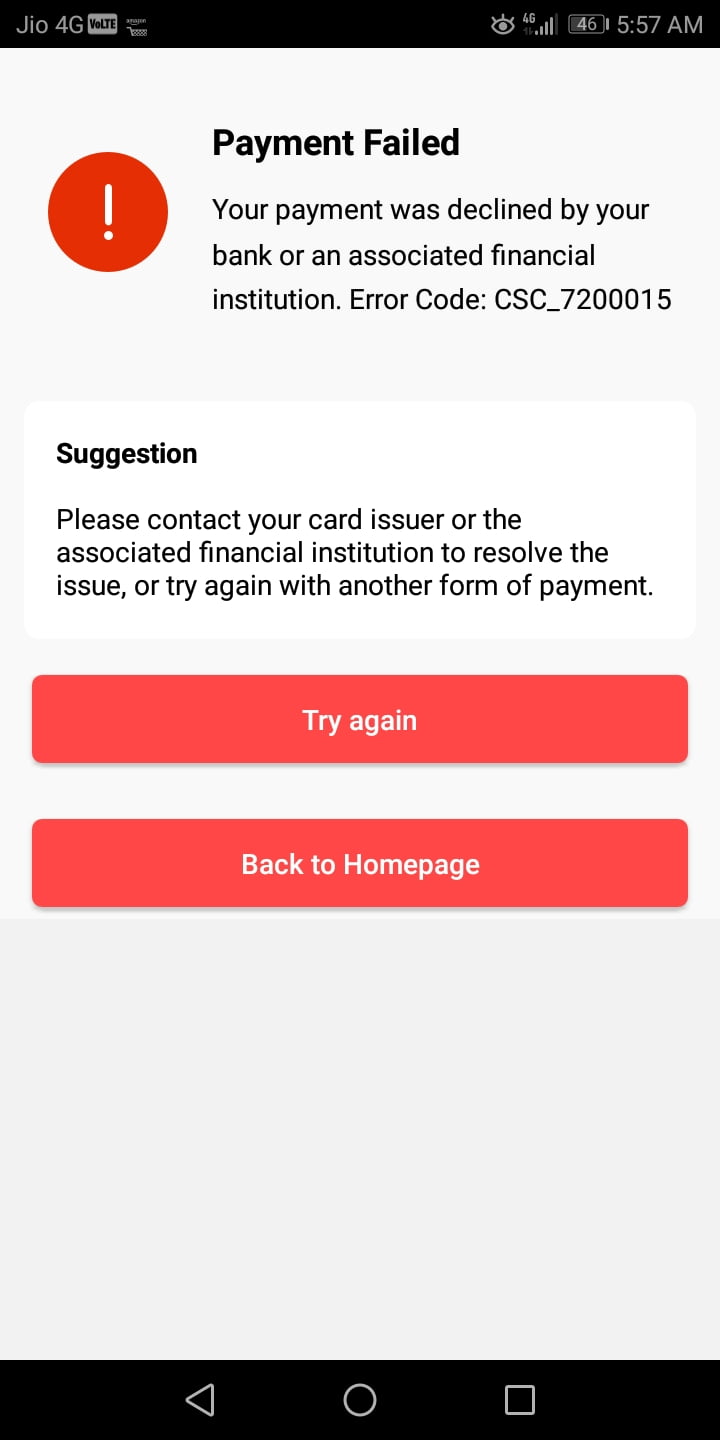

Transaction Decline Charges

A charge of?

When there is any decline transaction due to insufficient balance then the customer has to pay 25 + applicable taxes.

International Transaction Charges

1. The charge for international cash withdrawal is Rs.150 per transaction.

2. The charge for international balance inquiry is Rs. 25 per transaction.

Cardless Cash Withdrawal (IMT)

1. It is free for up to 1 transaction in a month

2. Rs. 10/- is charged per transaction after the first transaction.

Kotak Mahindra Bank Transaction Charges

The Kotak Mahindra Bank charges a cross-currency mark-up of 3.5% on foreign currency transactions carried out on Kotak bank debit cards. As per the terms and conditions of Visa and Mastercard, the exchange rates vary. Prevailing at the time of purchase. Note:

1. The Financial Transactions are Cash Withdrawal.

2. Non-financial transactions include PIN change, Balance Inquiry, Mini Statement.